Pre-1965 U.S. dimes which are struck from a 90% silver, 10% copper alloy remain one of the most practical, privacy‑friendly ways to own physical silver in 2025. Often called “junk silver” when sold for metal rather than collectibility, these coins pack a surprisingly high silver content per face dollar, keep per‑ounce premiums low, and are instantly recognizable in everyday trades. This guide walks you through exactly how much silver is in a dime, shows melt‑value math with clear examples, compares dimes to bars and American Silver Eagles, lays out buying strategies for local and online purchases, and covers risks plus counterfeit checks. By the end you’ll have the simple formula for melt value, sample calculations at common spot prices, and practical tips for stacking circulated dimes without overpaying numismatic premiums helping you decide if fractional silver belongs in your toolbox for divisibility, privacy, and cost‑effective metal exposure.

What pre-1965 90% silver dimes are and why they matter

All U.S. dimes struck through 1964 are 90% silver and 10% copper. Their value comes from predictable metal content, wide public recognition, and relatively low trader premiums compared with many minted bullion rounds. Markets price silver by the troy ounce, and dimes convert that ounce into handy, small‑value units that are easy to count, split, and use. In 2025, inflation concerns and periodic dollar weakness have pushed savers toward tangible, divisible stores of value and that renewed demand helps explain interest in these fractional coins. Below are three practical reasons many buyers prefer pre‑1965 dimes.

- Privacy: They can be purchased and stored discreetly and used in private barter without leaving a digital trail.

- Divisibility: Small face values let you transfer precise amounts and make change easily.

- Lower premiums: When minted bullion spikes in premium, circulated 90% coins often trade with narrower spreads.

Knowing which dimes are 90% silver and the exact silver per coin makes it easier to value rolls and bags by melt rather than collector appeal.

Which U.S. dimes contain 90% silver and what people mean by “junk silver”

Every U.S. dime dated 1964 or earlier is 90% silver: that includes Roosevelt dimes (pre‑1965) and older Mercury and Barber dimes. “Junk silver” is simply circulated coinage sold for metal content rather than rarity common‑date Roosevelt dimes in average circulation grades are the typical junk‑silver units buyers seek. Rare dates and high grades carry numismatic premiums; if your goal is metal, stick to common circulated examples to avoid paying extra for collectibility. Remember the 1964 cutoff and focus on circulated coins when stacking for melt value.

How much silver is in one pre‑1965 dime?

A pre‑1965 U.S. dime weighs 2.50 grams and is 90% silver by mass. Multiply 2.50 g × 0.90 to get 2.25 g of silver per coin, then convert grams to troy ounces (1 troy ounce = 31.1034768 g). The math: 2.25 g ÷ 31.1034768 g/oz = 0.07234 troy oz of pure silver per dime. Ten dimes ($1 face) therefore contain 0.7234 troy oz of silver, and a standard $1,000‑face bag of dimes will contain roughly 715–723 troy oz of silver depending on wear and exact counts. Keeping these conversions top of mind makes pricing by melt, comparing “times face” quotes, and translating spot moves into dollars easy and consistent.

Roosevelt, Mercury, and Barber dimes that are common‑date and circulated share these weight and purity attributes, which is why dealers and private parties treat the dime as a consistent fractional silver unit.

| Specification | Measurement | Notes |

|---|---|---|

| Coin weight | 2.50 grams | Gross weight per pre-1965 dime |

| Purity | 90% silver, 10% copper | Standard U.S. silver coin composition pre-1965 |

| Silver per coin | 2.25 grams | 2.50 g × 90% |

| Silver per dime (troy oz) | 0.07234 troy oz | 2.25 g ÷ 31.1034768 g/oz |

| Silver per $1 face | 0.7234 troy oz | 10 dimes × 0.07234 oz |

Use this quick reference when converting spot price into melt value or comparing dimes to other silver options.

How to calculate the melt value of silver dimes in 2025

Melt value = current silver spot price × silver ounces per face dollar. For dimes that becomes: Spot Price × 0.7234 = melt value per $1 face. That constant comes from the coin‑level math shown above and is how dealers quickly price rolls, bags, and loose coins. Dealers also quote “X times face” for example, 23× face which you can translate into dollar value by multiplying face value by that factor. Below are sample outputs at common spot levels so you can check dealer quotes in seconds.

| Spot Price (per oz) | Melt per $1 Face (Spot × 0.7234) | Melt per 100 dimes ($10 face) |

|---|---|---|

| $30.00 | $21.70 | $217.00 |

| $35.00 | $25.32 | $253.20 |

| $40.00 | $28.94 | $289.40 |

This linear relationship means small spot moves change roll and bag totals predictably knowing the 0.7234 multiplier saves time and helps you spot good offers.

What’s the exact formula for dime melt value?

Melt per $1 face = Spot Price (USD per troy oz) × 0.7234. That comes from 0.07234 troy oz per dime × 10 dimes per $1 = 0.7234 oz per $1 face. Keep your units straight: spot is USD/oz, the multiplier is oz per $1, and the product is USD per $1 in metal value. Use this for quick mental math or a spreadsheet to compare dealer quotes to intrinsic metal value. Note that dealer prices can include premiums, rounding, or fees that move the realized price away from pure melt.

How does the current spot price affect dime value?

Spot moves translate directly to melt values. At $30/oz, a $100‑face roll (100 dimes) is worth $217 melt; at $40/oz the same roll is worth $289.40. Dealers may quote premiums, dollar‑per‑ounce prices, or multiples of face converting between those formats helps you evaluate offers. For any quote, divide the dealer price by face value to get the implied times‑face, then compare that to the spot‑derived melt to judge fairness.

Why choose silver dimes over bars or Eagles?

For small‑scale, everyday practicality, circulated 90% dimes often beat other silver vehicles. Bars concentrate metal into large units that are awkward for small trades; American Silver Eagles carry mint and brand premiums that rise in rallies. Dimes are easy to split into exact change, widely recognizable by sight and feel, and accepted in many barter situations without formal assay. The table below summarizes the practical tradeoffs.

| Entity | Divisibility | Recognition / Assay | Typical Premium | Barter Utility | Best Use Case |

|---|---|---|---|---|---|

| Pre-1965 Dimes | Excellent | High (no assay for common dates) | Low-medium | Excellent | Small-value barter & stacking |

| Silver Bars (1 oz+) | Poor | Requires assay for unknown sources | Low per oz (when large buys) | Poor | Large holdings & storage efficiency |

| American Silver Eagles | Good | High (trusted bullion) | Medium-high | Good | Collectible bullion & brand trust |

That comparison explains why many stackers keep circulated dimes for day‑to‑day utility and reserve bars or Eagles for large aggregation or branded bullion exposure.

Why are dimes more divisible and easier to recognize?

Ten dimes equal one dollar face, so you can match small prices exactly without fractions. That divisibility matters in barter: you can hand over a single coin or several to meet a price, making dimes practical for groceries, favors, or micro‑transactions if traditional currency rails are disrupted. Common‑date dimes also have consistent weight and appearance, so the public accepts them more readily than generic planchets or unbranded bars that might need testing.

How do dimes usually carry lower premiums and better barter utility?

When branded rounds spike in premium, circulated dimes often trade with smaller incremental markups because their value is driven by metal content, not mint prestige. Demand for fractional, spendable metal narrows spreads during liquidity events. In local barter settings markets, farm stands, or small retailers dimes act as practical “barter coins” thanks to their familiarity and manageable size. For buyers who want low per‑ounce cost and everyday utility, that combination is compelling.

Where and how to buy pre‑1965 silver dimes in 2025

We recommend a hybrid buying strategy: inspect coins locally when possible, then use reputable online dealers for price and scale. Local shops let you handle coins, verify condition, and build a relationship that can surface inventory; national online dealers usually offer deeper stock and spot‑tied pricing that helps on larger buys. When buying online, favor dealers with transparent pricing linked to live spot, insured shipping, solid return policies, and clear condition descriptions. The checklist below helps you decide when to buy local versus online and what to confirm before paying.

- Inspect local coins in person to verify condition and avoid shipping damage.

- Compare online quotes to live spot using the melt formula to ensure competitive pricing.

- Confirm return policies, insured shipping, and clear coin‑condition descriptions before buying online.

At BullionExpress.com, we offer the tightest spreads, live spot-tied pricing, huge inventory (ranging from $5 rolls to $1,000 bags); same/next-day insured shipping; free shipping over $149. Most customers use us for bigger orders because we consistently beat or match anyone nationally.

Should you buy from local coin shops or online dealers?

Local shops are great for hands‑on learning, immediate delivery, and building a trusted relationship especially helpful for beginners learning to spot acceptable circulation grades and avoid fakes. Online dealers usually win on inventory depth, consistent spot‑linked pricing, and bulk discounts, so they make sense for larger or repeat purchases. When using an online seller, verify live spot linkage, insured shipping, accurate condition photos, and a transparent returns process so you can turn a “times face” quote into a spot‑checked melt value without surprises. Use local shops for small, tactile buys and online dealers for scale and price efficiency.

What are BullionExpress.com’s unique offers for silver dime buyers?

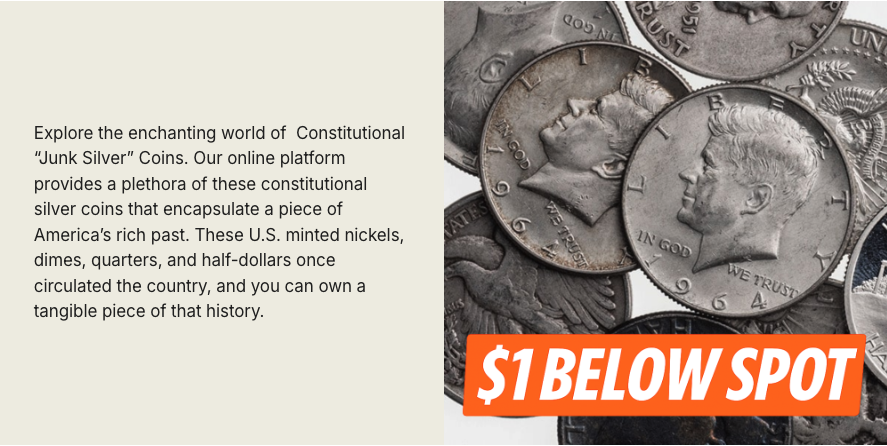

Explore our selection of Constitutional “Junk Silver” Coins. Our online platform provides a plethora of these constitutional silver coins that encapsulate a piece of America’s rich past. These U.S. minted nickels, dimes, quarters, and half-dollars once circulated the country, and you can own a tangible piece of that history.

https://bullionexpress.com/product-category/silver/silver-coins/us-mint-silver-coins/constitutional-junk-silver-coins

Risks and best practices when investing in silver dimes

Risks include counterfeits, confusing “times face” pricing, and overpaying for numismatic specimens. The best defense is a routine of simple physical checks, clear price math, and buying from reputable sources. Use non‑destructive tests, verify weight and diameter, and favor sellers with insured shipping and fair return policies. Know the difference between numismatic premiums and melt value so you pay for the benefit you want metal for stacking, rarity for collecting. The short checklist below highlights practical steps for new and intermediate stackers.

- Verify the math: Always convert dealer quotes to melt using Spot × 0.7234 before accepting “times face” offers.

- Prefer reputable sellers: Choose dealers with clear return policies and insured shipping to reduce dispute risk.

- Insist on inspection: For local buys, handle coins and check weight/appearance; for online buys, demand clear photos and buyer protections.

Following these steps lowers your chance of fraud and pricing mistakes while keeping stacking efficient and cost‑effective.

How to spot fake silver dimes

Start with simple, repeatable tests and watch for red flags. Silver is non‑magnetic, so a magnet test is a quick first check. Authentic pre‑1965 dimes weigh 2.50 grams and have precise diameter and edge milling; deviations in weight or a magnetic response are immediate warnings. A specific‑gravity test adds confidence. Also inspect strike details, edge milling, and the coin’s acoustic “ring” genuine silver rings clear, base‑metal fakes often sound dull. When unsure, request provenance, buy from sellers with returns and insured shipping, or get suspect coins tested professionally.

What circulated condition is best for stacking?

Average circulated condition is ideal for stacking: it keeps premiums low while preserving full silver content. Toning and light wear don’t change melt value, but collector‑grade eye appeal does raise prices without adding metal. If your goal is metal, choose common‑date circulated rolls or bags they keep per‑ounce costs close to melt and preserve the divisibility and barter utility that make dimes valuable.

How the economic backdrop affects silver dime investing in 2025

From 2022–2025 we’ve seen persistent inflationary pressure, intermittent dollar weakness, and constrained mine production forces that together lift retail and private demand for physical silver, especially small‑denomination units. Inflation pushes savers toward tangible stores of value, and fractional silver like dimes provides an affordable, accessible hedge for households that won’t or can’t buy large bullion lots. At the same time, growing industrial demand from renewables, electronics, and medical uses creates structural support for prices, tightening the supply/demand balance and making physical holdings more attractive. Practically, fractional silver can serve both short‑term defense and long‑term strategic roles inside a diversified precious‑metals allocation.

Why inflation increases demand for physical silver dimes

Inflation erodes confidence in fiat purchasing power, so people seek tangible assets that hold value. Dimes let small savers acquire physical metal in manageable amounts. The behavior is straightforward: when purchasing power slips, buyers prefer assets they can use or barter, and 90% dimes meet that need affordably. That’s why inflationary periods often bring renewed interest in circulated fractional coins.

How industrial demand supports long‑term silver value

Industrial consumption from solar panels, EVs, electronics, and medical tech uses a meaningful portion of annual silver supply and supports long‑term price floors when demand growth outpaces new mine output. Rising industrial demand reduces availability for investment uses, putting pressure on supply and producing periodic deficits. When supply tightens, investor behavior matters more, and physical ownership captures both industrial‑driven appreciation and monetary‑hedge benefits. That structural backdrop complements short‑term motives and is one reason many investors include physical silver in portfolios.

- Industrial demand is a structural driver: sectors like solar and EVs increase long-term consumption.

- Supply constraints matter: limited new mine growth tightens the market and raises price sensitivity.

- Physical holdings hedge both monetary and industrial risks: silver serves multiple economic roles.

These production and demand links explain why fractional coins remain a practical part of the broader silver market.

Frequently Asked Questions

What are the best practices for storing silver dimes?

Store dimes in a cool, dry place to minimize tarnish. Use coin flips, tubes, or capsules to prevent contact and abrasion. Avoid high humidity and large temperature swings. For sizable holdings, consider a safe or safety deposit box for added security.

How can I sell my silver dimes effectively?

Start by calculating melt value from current spot. Compare offers from local shops and reputable online dealers, and be transparent about coin condition. Selling in bulk usually lowers transaction costs. Building a relationship with a trusted dealer often yields better offers over time.

What should I look for when buying silver dimes online?

Choose dealers with clear pricing tied to live spot, good reviews, insured shipping, and a fair returns policy. Look for detailed photos and condition notes. Always compare the dealer’s price to the spot‑derived melt value before buying.

Are there tax implications when selling silver dimes?

Yes. Profits from selling silver may be subject to capital gains tax in the U.S. Keep accurate records of purchases and sales (dates, amounts, prices). Consult a tax professional for advice tailored to your situation.

How do I determine the authenticity of silver dimes?

Use basic tests: a magnet check (silver is non‑magnetic), precise weight (2.50 g), diameter, edge milling, and a sound test. If you’re unsure, consult a reputable dealer or grading service for verification. Purchasing from trusted sources reduces counterfeit risk.

What are common mistakes to avoid when investing in silver dimes?

Common errors include overpaying numismatic premiums when you want metal, neglecting to verify a dealer’s reputation, and misunderstanding “times face” pricing. Keep clear records, avoid impulse buys, and do the math: convert any quote to melt using Spot × 0.7234 before committing.

Conclusion

Pre‑1965 silver dimes offer clear, practical advantages: divisibility, privacy, and generally lower premiums than many minted rounds. Learn the melt math, buy from reputable sellers, and focus on circulated, common‑date coins if your goal is metal rather than collectibility. With the right approach, fractional silver can be a flexible, cost‑effective way to add tangible value to your savings start small, do the math, and scale with confidence.

Shop Silver Dimes Now